Reduce your taxes by 90%

through Cyprus tax residency

An increase in personal income tax rates to 45% and higher

Complex processes of filing declarations and justifying the source of funds

Strict requirements for the placement and movement of capital worldwide

In times of political and economic instability in Europe, the issue of capital relocation and tax optimization is most relevant.

For 20 years, since its accession to the European Union, Cyprus has been a reliable jurisdiction for the relocation of capital, and tax rates are among the lowest in Europe. Cyprus is also governed by English law, which ensures the reliability and safety of investments.

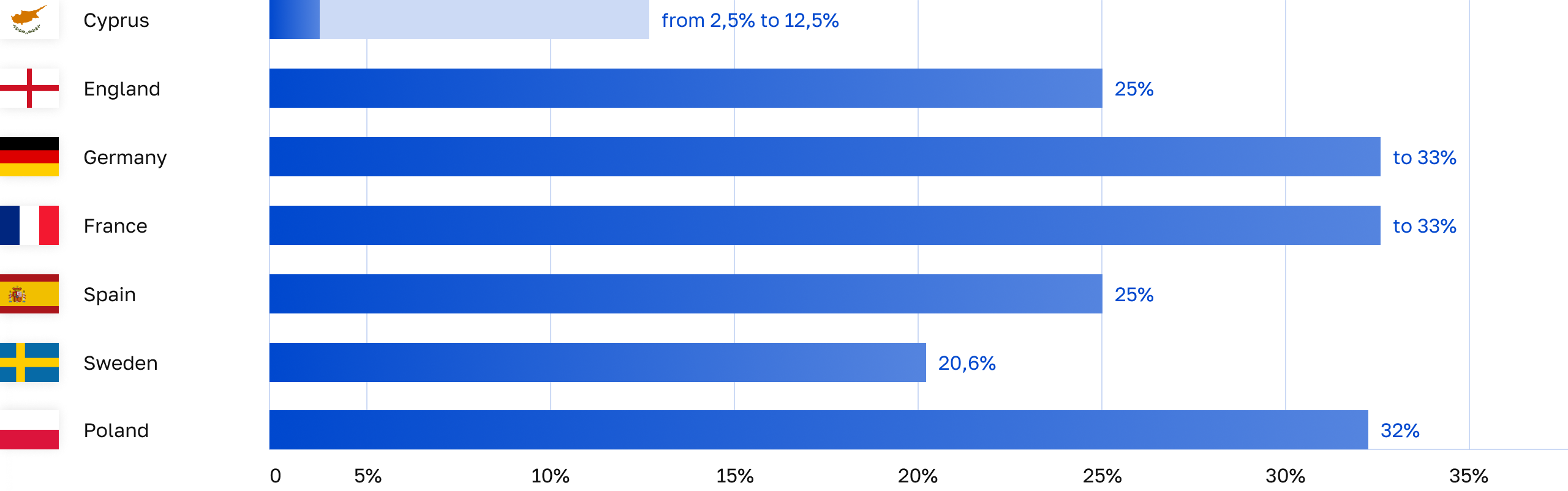

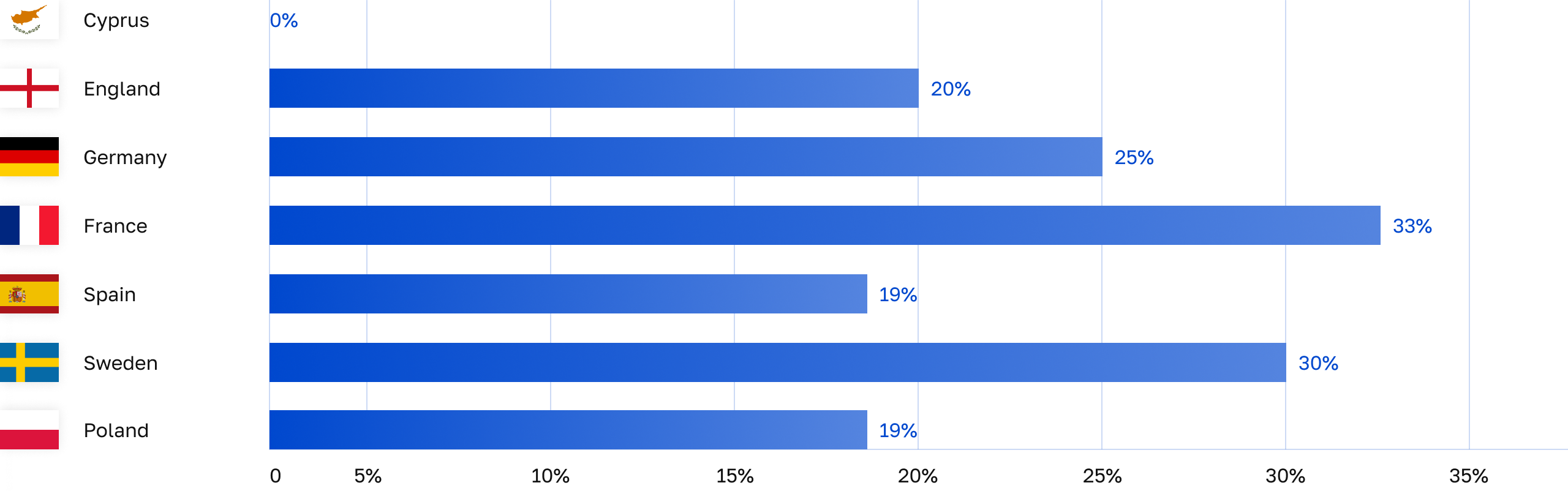

Cyprus has some of the lowest taxes in Europe. The country's tax system is one of the most favorable in the European Union in terms of rates, benefits, and the opportunity to obtain tax residency status.

Corporate Tax under the IP Box Regime

Personal Income Tax for Cyprus Tax Residents with Non-Domicile Status

Standard corporate tax

One of the largest game developers in the world, with 5,500 employees and headquarters in the capital of Cyprus

Trading platform and the largest retail broker with a monthly turnover of 4 billion transactions

Investment platform with revenues of more than €1.2 billion per year, has more than 30 million users

A global corporation, software vendor and service provider with over 26,000 employees

An American company with revenues of more than €7 billion per year that creates specialized computing technology for a variety of industries

Europe's largest IT distributor with operations in 60 countries, headquartered in Cyprus

Obtaining the status of a tax resident of Cyprus will allow you to optimize your taxation. You are entitled to tax benefits, if you own a business, run a company or are employed on the island. or employed on the island. There are two types of tax residency in Cyprus: actual and declared.

A person who was born or has lived in Cyprus for at least 17 out of the last 20 years and who is present on the island for more than 183 days a year is considered a tax resident.

In this case, all income earned by this person from any point in the world is subject to taxation in Cyprus.

A person may be a tax resident of another country but have property, a business, or other connections with Cyprus.

In this case, income earned in Cyprus is subject to taxation in Cyprus, while income earned outside Cyprus is not taxed by Cyprus tax authorities.

It is important to note that the country has a double taxation system that avoids double taxation of income earned by individuals in Cyprus and abroad. Agreements on the prevention of double taxation have been concluded with more than 67 countries, including the UK, Germany, Ukraine, the USA and most European countries.

Cyprus operates a judicial system based on English law, which ensures the security of investments and the protection of capital.

According to the European Commission, Cyprus is among the top four Eurozone countries with the highest growth rates.

Cyprus is among the top 15 countries in the world for attracting foreign direct investment.

The SPM team will help you make the right decision regarding investment, business and life in Cyprus and advise you on everything from market analysis and business relocation to assistance in obtaining permanent residence in Cyprus through investment programs.

We have excellent market knowledge, communicate with the best developers and specialize in investment management consulting.

Our long-term experience of living and doing business in Cyprus allows us to adequately assess the situation and build a business model for your purposes with the expectation of return on investment from 8% per annum.

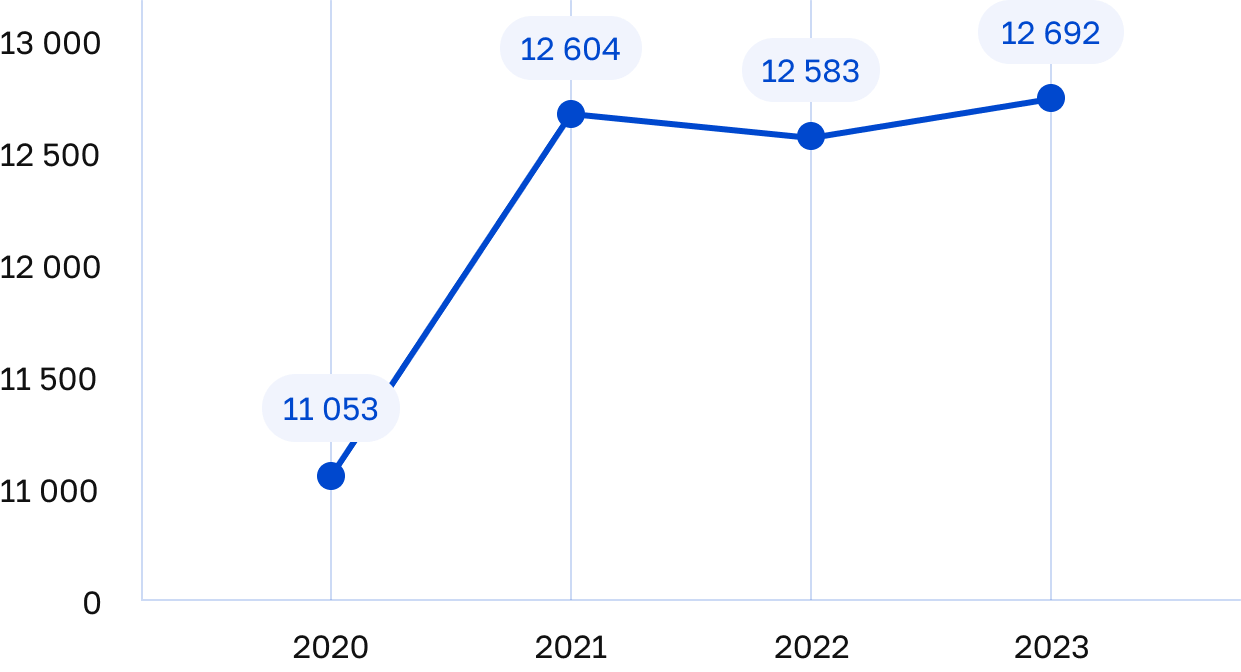

Capital Relocated to Cyprus

Families and employees were assisted with the move and settlement on the island.

We operate in the Cyprus market

Useful material